|

PUBLIC BLOG | MEMBERS | ABOUT SVT | CONTACT |

|

|

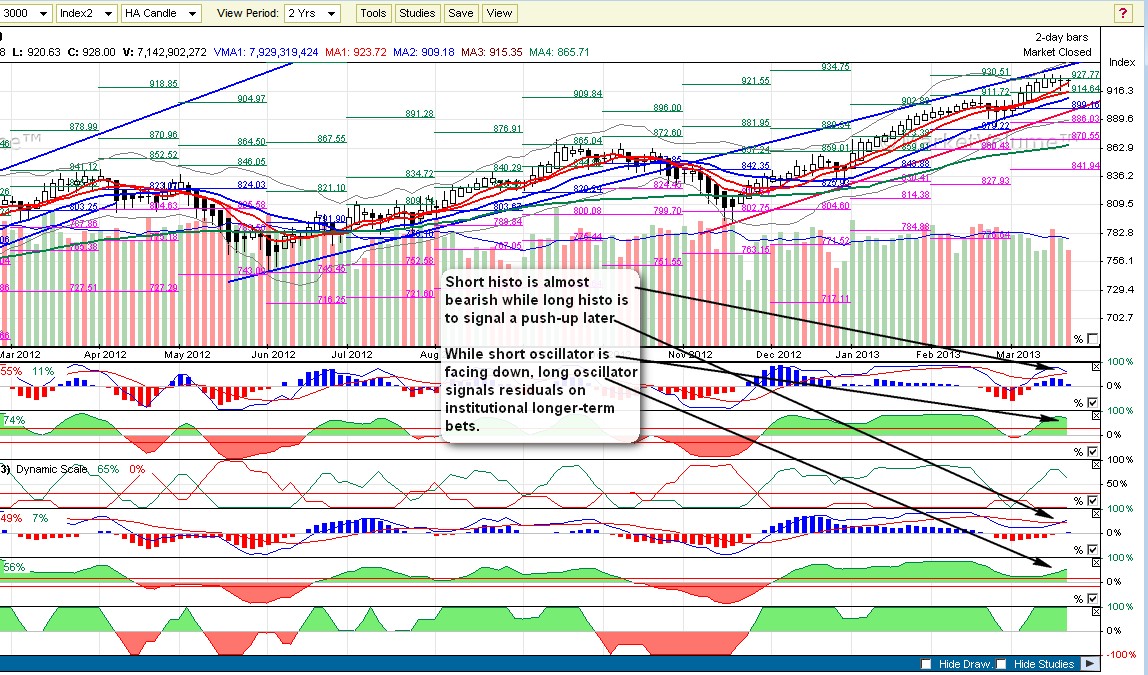

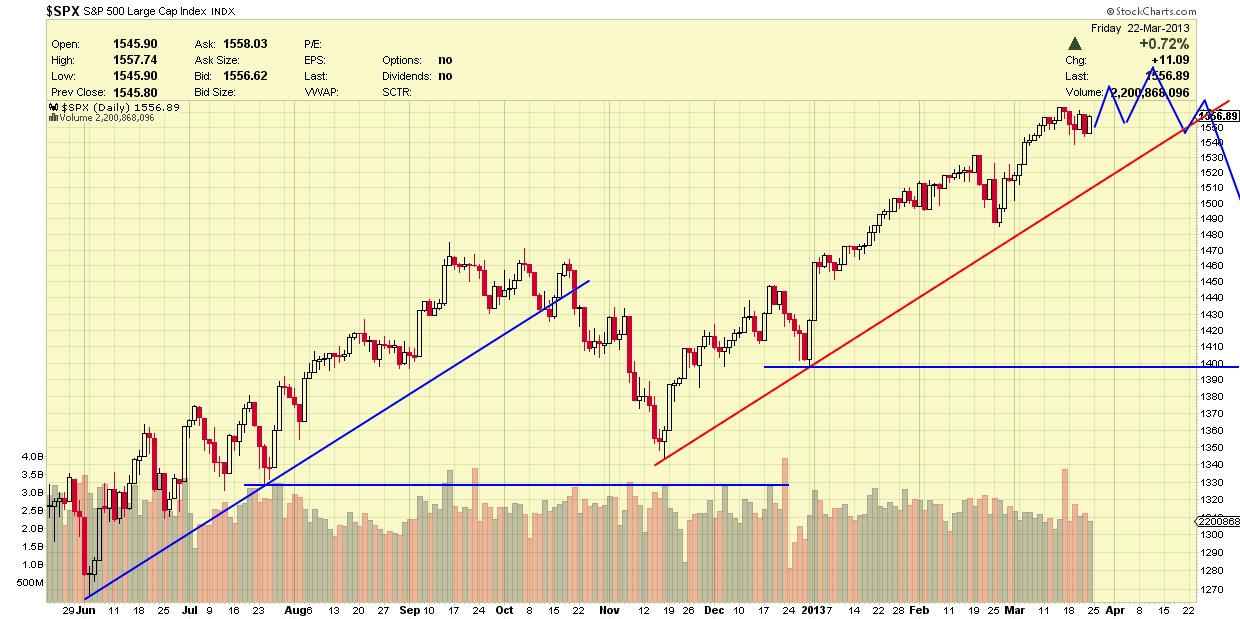

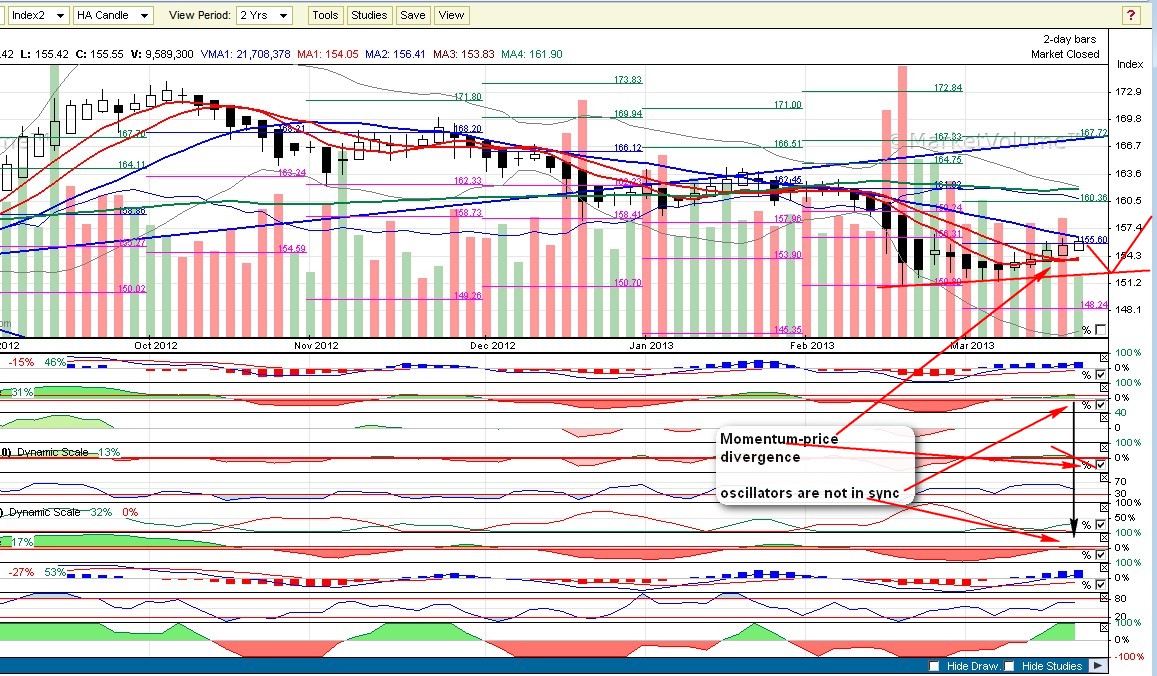

25-MAR-2013 Week-end post I have no words... communism is back... and the idea of the red disaster comes from EU. It's a sarcastic situation from Mr. History to cut up to 40% of bank accounts have more than EUR 100k supposed to be owned by 'bad boys from Russia' - the original source of the worst and most killing society. Policy makers of EU made an extremely bad decision. They just opened an injury on the heart of capitalism: immersed the knife to the centre of the monetary system: safety of capital. They keep bank accounts closed above EUR 100k in Cyprus for an uncertain period and will slash with an uncertain portion 25-40%. It was obvious for years policy makers of EU are slow idiots, but their decision now is a beginning of the total collapse of Euro and a false dream of European Union. EU -this totally bad concept since it's start- will fall apart slowly and painfully. Germans are happy now -including Mr. Schaeuble- they will not support the bank system of Cyprus having money mostly from Russian sources. Short-term impact will be nice and euphoric... but the medium and long-term will carry terrible consequences. As I said before: if it could happen with Cyprus with approval of EU and IMF to close bank accounts and slash them in the name of bailout, same can happen to Italy and Spain? This fear won't get voice now but believe me, will play an important role in the future. When bank accounts -core of capitalism- are not safe, the society itself is not safe anymore. Also, believe me, playing with rich Russians is a bad idea. This action can easily lead to a row of hidden revenge actions like shortage in natgas supply... I wouldn't be surprised seeing 'failures' in natural gas delivery to Germany and other EU countries next winter... Also I would not close out a possibility of a war... Just imagine, you have a bank account and it is suddenly closed and 25-40% is cut... won't you be angry? Russians have a different culture. Human life worth almost nothing there. Russians are violent and merciless... Actually they killed more than you can imagine in the last 100 years. They still have weapons, nuclear power and good army. They are full with commodities and over of a multi-decade financial crisis. They are strong and independent again. I understand that Germans and French could not sell the idea of supporting an another EU country using the money of their taxpayer citizens in order to save bank accounts of a semi-legal tax heaven mostly sourced from a non-EU country... I'm sure they had lots of pros and contras... But now they dropped a piece of metal into the jet-engine will slowly hurt all the parts of it and the sequence of failures will lead to a crash, where all the airplane will explode. Anyway, that drop will make nice money for us as it will generate a global impact: a multi-year financial crisis. We will do nothing more than change our hats and go short when time comes. Of course, nothing is direct on stockmarket and we are in the middle of a global QE. We need to store the bad step of EU decision makers in our brain and wait as long as we will not detect traces of a global liquidity trap. Then, and only then we will go short and make nice money on a historical decline of stockmarkets. That event will come for sure. It started now and will manifest within a few months... maybe this autumn. Our methodology will protect us having money in equities. This system works for years now and will help us to detect the traces of weakening internals. While I was gloomy with my words about Cyprus and EU-idiots, we need to go back and focus on trading. Equities First of all Apple: we gave a forecast for apple to rise last week-end and it could bump from pivot 424 nicely. However, current setup is a fake bull as long vs. short oscillator is -25/+5. Odds are high for a correction will start in 2-4 trading days. As SBV selling volume is 18% (while buying is 31) we need to wait for steady zero level selling volume in order to measure a fakeout II stage. RUA: The largest volume equity index just gave an almost-bear cross on short histo. As long oscillator is on 56%, one more push up after a slight correction has high odds. SBV flow is still on 100% level. Volume momentum declined in the last 4x2 trading days to 1.02 and almost to give bearish pre-signals. QE4 is in a full steam, however, we can see: institutions pulling out their money and take less and less risk having their money in. Chart above is RUA 2D fakeout. Please observe short histo versus long histo and short oscillator versus long. Chart above is RUA 2D. Please observe declining momentum versus rising prices. Chart above is VIX 1D stocksharts. Vix has a gap-down now meaning high odds for rising equities. Chart above is NYMO 1D stockharts. Divergence of NYMO versus prices are obvious. Safe part of the rise is over for a month now. Downward risk is rising, so I did not initiate a new entry before the recent rise. Chart above is SPX 1D stockcharts. I tried to sketch a possible projection for equities based on past QE flow, current volume and classic TA setups. We could catch the rise of equities since last year and made a nice sum. However, as downward risk rises I did not initiate a jum into equities third time. Unfortunately we must accept: current situation carries more risk than potential profit. Dollar Chart above is dollar 2D We could tract the current dollar bull almost since it started this February. We detected a bull cross on short SBV on 11th of February, later we had a confirmation on long SBV. This bull is exhausted on dollar. Long and short oscillators started to sync: they are in a 14:15 setup meaning institutional bets declining on both timeframe. Odds are high for a bearish continuation. Please note that dollar just made a doji HA last Friday on 2D chart meaning indecisive bias regarding to dollar. Also, we still have pretty high level of SBV bullish flow. Short histo gave a bear cross on 18-MAR, since dollar is practically moving sideways. Long histo is also bearish, but as long as we have no elevated selling volume on SBV we must practice caution here. Also, dollar traders love to make a last spike on dollar before a trend-change. Declining dollar with rising equities is a matching pattern. Odds are high for a last spike on equities and bearish dollar move. However, when VIX will close it's gap-down, we will get too low VIX readings for a further rise, therefore a few days of slap for dollar bears has high probability Oil Chart above is USO 2D We made a nice entry for oil last week with a low risk potential. Please note that inherited trend-line stopped the recent decline for oil. Also, historically working, two MAs helped us to set up a trading point and a stop as well. As you can see, both oscillators are bullish and we have a flat zero selling volume. Ocillators are started to converge, but long oscillator is not rising as quick as it should. While SBV flow is bullish, both AD vol sentiment and MFI are facing down. Odds are high for a short-term rise, but then correction has high odds. Timing is a question, I place that correction for the time when the last push-up for equities is over, maybe the second half of this week. We will move our stop and will take profit soon I feel. We made nice money by riding the trend of oil last December and we must understand the risky environment now. Gold We had a pretty easy task to make a forecast for equities and oil, same true for dollar. Our headache starts at PMs I feel. We can have a pretty safe statement regarding to gold's short-term setup: we measured a constant fake bull situation for gold since it started to signal a bullish histo, later a bull cross for SBV. Now we have two, important setups: first of all, SBV selling volume became zero just now, so we are on a stage II. fakeout: oscillators are not in sync and short oscillator is almost 2x bigger than short oscillator: this is a fake bull setup ordering high odds for a correction. Also, please observe a momentum divergence: while prices were mostly up, momentum started to decline. As prices were rising in front of rising/side moving dollar, also we have a 100% SBV Flow, our projection is a correction with a bullish translated trend-line meaning gold will not be able to kick stops under it's recent lows. I must repeat: odds are high for this setup, but we don't know the future. If our projection is right, millions of PM traders will recognize the bullish nature of trendine. While it's not worth to put money in equities, gold's recent, multi-month death will make it worth again to buy. Chart above is gold 2D fakeout Palladium started it's fake bull bearish cycle last week and now selling volume on SBV elevated. As palladium usually leads the PM complex, we have a confirmation on our gold projection I feel. Silver had a similar setup to palladium last week and now has a 10/10 SBV cross after a bullish SBV signal paired with a -48, bearish SBV flow. Price manifestation of the recent, high probability bearish volume cycle is weak so far. This week will deliver us lots of information about the generatl strength of the PM sector I feel. Miners We dectected improtant, bullish signals for miners a week ago. Juniors and GDX delivered us the first signals, then now, HUI joined to the queue. chart above is miners 2D As you can see, both histos are in sync and delivered a bull signal early last week. We have flat zero selling volume paired with slight +7/0 oscillators. We have a slight bullish reading on SBV Flow unfortunately. Miners are ultra sensitive for both weaknesses of gold and equities, and we expect some correction for both this week. While it's obvious we can see something important for miners here, while gold and equities to struggle with their bearish cycles, miners will follow them or move sideways. Also V-MA is far away: more than 100 points between current price an the magic price level, so miners are under generally bearish market circumstances: slow rises followed by violent corrections. Treasuries Chart above is treasuries 30y 2D 30y treasuries delivered mixed signals last week with a slight bullish pre-signals. Now we have an elevated buying volume on SBV, so we can measure a fakeout: we have a rare volume setup here: an MVO bull/bear/bull switch. Usually this is a high probability setup for a trend-change will manifest on a violent way. Short-term odds versus long-term ods are -56/-46, so I would not be surprised on a quick-contra bear trick before that high probability bull arrives. As long as long histo is negative, patience should be practiced here, but then, odds are high to see a nice bull here. Natural gas Usually I prefer not to give forecast regarding to natural gas as we have a low-volume instrument to check it's internals. However, an MVO bull paired with a fierce MFI decline and a large volume SOS candle with positive HA means high probability of a few days of correction before a last spike. Chart above is UNG 2Df Trading update: hold existing stakes. We will move our stops this week, but most probably will wait for a right moment to take profit. Others might buy, but we must be contrary: catch when others cry and sell when others smile. Offie memo: I received extensions and returning member again. Many thanks for your kind subscription! Office memo2: there is a congestion in my mailbox. I will try to answer your questions/mails this week I promise.

More Posts... |

|

|

PUBLIC BLOG | MEMBERS | ABOUT SVT | CONTACT |

|

|

(C) 2004-2012 Deric O. Cadora and Atavia, Inc. Terms of Use | Links | Contact Futures and options trading is risky and not suitable for all individuals. |