|

PUBLIC BLOG | MEMBERS | ABOUT SVT | CONTACT |

|

|

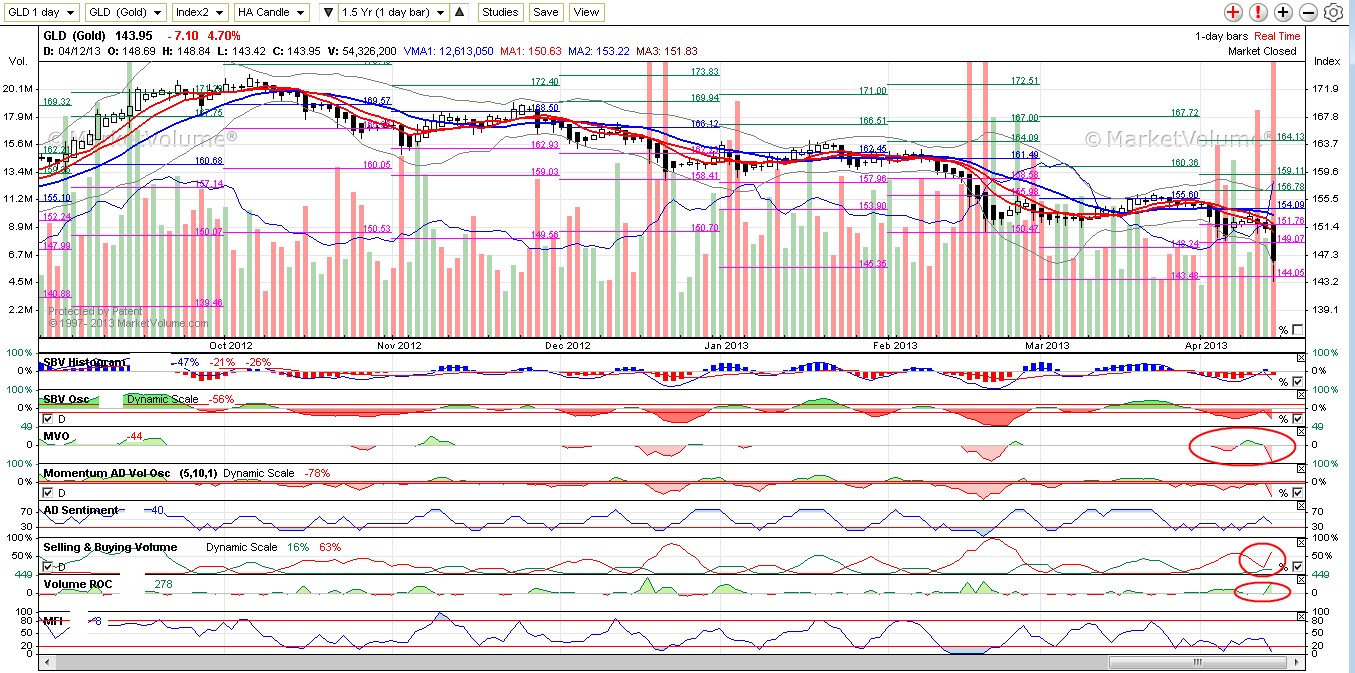

14-APR-2013 Week-end post It's early morning on Sunday when I have time to start to compile my week-end report. One of the reason of my changing quality in my English is the time when I write my posts. Weekdays I wake up at 5.00 or 6.00 a.m. and write sleepy and grumpy. My brain is active and creative in early mornings, but my language skills are well below my average. I write my posts, activate them, and later, early afternoon I read them again -if I have time. Then I see my clumsy expressions, grammar mistakes... or sentences I could substitute words with other synonyms, but it's too late for that time I feel. Also I don't like to deny myself: I'm the same person afternoon as in the morning. So I'm so sorry if I disturb you with my clumsy sentences now. Even my fingers move slow today morning to type. I was off for the last three days, spent my time in a spa and after a biiiig sleep. Finally spring is here and I'm so happy to see life is starting again: birds singing, we have sunshine after long months and sky is clear blue. Whatever happens with gold, silver and miners, doesn't matter. Life is beautiful. First tof all, a personal note: I receive emails about my method and system making note how good is it and still works while other methods give false signals etc. I received subscription last Friday for instance, just after the devastating decline of gold and miners. I received some emails how good is that I use stops and you could protect your money by using them helped you to lose less than a percent while others suffered a big loss on Friday. Also I receive compliments about riding SPX and OIL bull so precisely since last November... Many thanks for your kind compliments. Thanks a lot for your subscriptions. But fact remains fact: SVT portfolio is down if we strictly check our numbers since last November. We are still above 100% if we consider the full life cycle of SVT, however, again, since last November I 'finance' the loss of PM stakes with SPX and OIL gains. Even riding of SPX and OIL pretty successfully, again, SVT is in a negative balance if the first period is last Nov. Not a huge loss, but on an annoying level. I warned you several times since last December: dealing with PMs, gold and especially with miners is the most complex, kind of art-level in trading. Trading SPX with volume studies is an easy task I must say as it has volumes and so many great tools to detect trends and switches, also volatility is on a manageable level. PMs have small volumes, and they are volatile. Also institutional traders of PMs are tricky and do everything in order to screw money out of weak hands. This field is full with sharks. And actually, there are more and more giant fishes in this water and less and less food to eat here. A conteo comes now: I didn't want to share my theory so far but I will do now. Please don't read my rows if you hate conteos. This is my explanation about the current situation: CBs in major countries buy gold now. With the fiat currency system it is inevitable now, we are in a progress of currency war. CBs after CBs announce money-easing and we can see major currencies to collapse on a historical rate. This is a dangerous game I feel. Taking an example of Japan yen, that money is being destroyed officially since last December. BOJ takes debt and pushes it's money down in order to get rid of the deflationary spiral they are in for a decade now. This, centralized, artificial and quick turn of Yen can result a sequence of panic-sell of yen by yen-owner institutions can push Japan into a hyper inflationary spiral, meaning total collapse of a weak and exhausted economy. Japan needs to import their raw materials and energy. Pushing down Yen for a given extent is a good idea, but, oil-yen ratio can double or quadruple in a few days of hyperinflation is on. When hyperinflation is on, double-digit currency inflation in a day can happen... Similar process can be observed for other major currencies. They try to erode their debts by inflation, they are weakening their money. They can finance this manipulation by issuing treasuries for a while, but after a while debt-downgrades will happen and they will not be able to pay their treasury obligations. Then, they will issue new and new treasuries opening a debt-spiral. When inflation-war is on, we should never forget: debt is money and money is debt. Now, as a population, human beings are obliged to pay their debts and started to have less willingness to take additional debts, but hungry banks need debt as they need money: they targeted Central Banks (CBs) have less decision-makers but financed by large population: now they drifted to national-level. What you will see, countries will have larger and larger debts (treasury bills) and their population will finance those debts by paying more and more tax. Also national health insurances, and nation-level pension funds will be eaten by these, large debts: there will be less and less social net under the population. All the money will be streamed to government funds in order to finance gov-debts and treasury obligations paired with soaring commodity prices as commodities (sooner or later) will give clear indication about inflation. Here comes gold: after long years, national-level money will worth nothing and gold needs to be implemented as a historical unit of exchange of goods. Long years needed for that revolution and the form of that system is not clear, but before implementation of the new money (maybe a single, global money) there will be a currency crisis. Then, for that period gold will be an extremely important tool for survival. So, while CBs inflate, I feel gold price is in the progress of being pushed down and to be traded on leverage ending with an obligation of physical delivery. With other words: CBs or their affiliates invest money to drag gold prices down and be on the physical end of commodity exchanges. Exchanges let you to play 10x leverage on gold for instance meaning if you step in a good time, your money will worth 10x in gold at delivery than the money you need in order to control that amount. Great business isn't. Now imagine that you have lots of money and your target is not to make 10x but 1.5-2x as you would like to have real gold in the end of the channel. Maybe 1.2x is good or 0.9 is good as well, as you will inflate your freakin' money and the profit you make on gold long-term will make back your loss. Stress is on delivery and owning physical. Gold futures for example, need to be delivered. So, something what is virtual and leveraged will be physical in the end. US comex -CME- is one of these miraculous places. Owning a gold mine? Why if we have a place to make money actually cheaper than gold itself and less time? Take a look into the delivery calendar of gold: http://www.cmegroup.com/trading/metals/precious/gold_product_calendar_futures.html My theory is governments stepped in to gold-trading via hidden agreements with some institutions and started to play a different game than we saw before: they have strong muscles, they inflate their money and in turn, they spend some in order to hedge their own inflation with... with gold. It means you fights against not sharks anymore, but ten-times bigger creatures started to eat sharks in this water. Now, if you still want to play in this game, you need to have good, steel-nerves and hide under a rock. First of all, you are out of interest now: giant creatures need to eat much bigger animals than you. Also you need to hibernate yourself and not to move as long as they are here, above you. You are not a direct target anymore, but you are in danger to be eaten if you swim into too close to the jaws of these creatures. The great thing is to have the right for a decision (as per moment you have the right to decide, but as governments will be more and more hungry, actually you will need more tax) at least to participate in the game of fighting for gold or leave this more and more hot water. Exposure of PMs in SVT portfolio became around 50% again and we are 1x leveraged meaning time is not against us. So the strategy is to find other waters to feed ourselves and wait for the fight to be finished here in PM waters. It's all. Selling PM positions now is a really bad decision. Patience is a key. Few more weeks or months and there will be no more seller, only buyer. Gold and silver exchange will be done, majority of physical will be under the lock of CBs and major players, but there will be a constant demand for gold for that time. The only free source will be humans (maybe owning gold will be forbidden or under governmental control - yes it happened in the history) and.... miners. That will be a time of recognition of severely undervalued miners as a true source of gold. Price of them will just fly and dream gains will be there. Same true regarding to gold. Just imagine a free-market situation where most of the physical will be under lock. Remaining available gold will represent a huge value and there will be a big fight for that. Gold prices will fly. The question is timing. If you posses leveraged products let me help you: -options: eventually shorter the period is and higher the strike than the current price, your risk is higher to lose you money. If you play with options, then you know how to run a risk profile analysis and make a decision -futures: if you are leveraged in futures, time is less against you, but don't forget about the effect contago/backwardation. I am sure if you are that serious to have futures in your hands you know what I mean. Also there is a risk to see a collapsing commodity exchange your futures are in as it might happen there will be no physical to be delivered but obligation is there. -3x ETFs: they have a time-erosion effect. Average time erosion owning a 3x ETF is about 0.8-1.2%/month -2x ETFs: same true here, time erosion is less. Average time erosion owning a 2x ETF is about 0.2-0.4%/month -1x ETFs: minor time-erosion (1-2% per year) risk is to have over-leveraged fund not tied to physical or have leveraged connection to the core product. -physical: no risk at all regarding to time decay, but less tradeable While money flows out of other currencies, US dollar started to be respected as a 'strong' currency. Just imagine the moment of recognition when increasing amount of money changed to USD realizes inflation is a reality for dollar as well... No safe heaven as stocks are stagnating, treasuries are questionable whether be paid back or not... Liquidity will try to find a safe place and one of them will be gold.... Sum up all the facts and factors I tried to list here and make your own judgement. Personally I believe, selling now is a really bad idea. Buying or holding is a great idea. And I will continue managing SVT portfolio based on this alignment. So, after a small, strategic discussion and unveiling my conteo, let's go back to facts. We trade facts here in SVT and not theories or wishes. Dream-trading leads to total burn of account. Gold Well, we identified a bear cycle on gold, silver and miners more than a week before this, strong decline. We detected an MVO bear surge mid of the last week for miners, silver and gold. We HAD a chance to see an MVO bear/bull switch and roll from 1D to 2D timeframe, but bear volume cycle of gold was stronger than the possibility for a trend-change. Chart above is gold 1Df Please observe a rare bear/bull/bear complex. I hope this MVO formation will not go to 2D timeframe. As per moment, this complex signals a clear MVO bear surge on 2D. Going back to 1D gold chart you can see something strange: while we could see a serious selling day, ROC changed to be bullish, also, after a day of true capitulation (54M volume meaning more than a 400% daily volume/avg volume day, buying volume remained elevated). We have a negative HA candle and a large volume selling day, but volumes talk about shadow-buying since 9th of April. We have something strange here I feel: while prices suffered a devastating day down, internals started to signal divergence and this is in progress for more than a week now. Let me show you something: I received a mail from Harry regarding to WSJ has a SOS-BOW chart based on their own method. As you know I don't care too much about widely recognizable methods to be used in my analysis, but accidentally BOW sheet on WSJ matches with our analysis now: they also recognized a BOW day ( http://online.wsj.com/mdc/public/page/2_3022-mfgppl-moneyflow.html?mod=topnav_2_3000 ). BOW chart of WSJ indicates a large BOW day for GLD SPDR with a large BOW number regarding to block trades. Block trades are mainly institutional trades. Sheet above is WSJ BOW chart, 12-Apr-2013 EOD. As you know, MV tries to detect institutional ticker-level volumes. While MV charts identify something strange, shadow buying behind Friday, this is a clear panic-selling day with negative HA paired with red volume bar. According to WSJ methodology it was a BOW day. I'm not so familiar with WSJ's BOW-SOS sheet money-flow calculation methodology. For instance, I don't catch why a daily total(118.69M) can be less than block (143.98M). Also, according to them total uptick volume + total downtick volume is 2.700M (1467+1349M) while Stockcharts reports a 55,588M volume day, TS gives an 55.601M volume day and my primary source of volumes-MV reports an 54,326M volume for last Friday. 3 of our sources give an 55M day for GLD while WSJ is about a 2.700M day. Difference is pretty large. Maybe I don't catch the way of their calculation. I hope I served you a proper answer Harry, regarding whether it was a BOW day or not. According to MV it was a selling day with panic sell but massive shadow buying over the period of SBV setup on 1D chart. Early this week MV 2D charts signaled an MVO bear surge on gold and miners. I was in the hope that 1D bullish volumes will roll to 2D finally and not 2D bearish volumes will destroy 1D developments. I made a buy based on the setup of 1D chart but applied tight stops in order to protect our capital. Finally all of our stops were kicked. As our purchases were prior to the big rise and we placed our stops a little under that purchase, our total loss is around 1% per instruments.... a manageable loss I feel. Now GLD has a pretty large gap and that gap to be filled. I know, I was in the hope of GDX gaps to be filled soon and we were close to the last gap to be filled as well, so you can claim why do I believe that GLD gap will be filled. As you know, volumes talk to us and I have one more note about /GC volumes: we had a 352.000.000 volume day on gold futures last Friday. Similar volumes are pretty rare we had similar in 2009 at peak, 2011 at peak and last Friday -not at peak. Actually more gaps we have on both GDX and GLD odds are higher for institutions to fill that unbalance sooner or later. Question is time now. We have 3 gaps in GDX now and 2 GLD gaps after last autumn. (well, I'm sure you'll ask now how will I deal with my personal NUGT trades. Now, I will continue with a gap-trade: small buys as long as there is no SL pushing my purchase average down. Then stop and wait. Purchases are small amounts don't risk my total account) Chart above is gold 2D chart. Please observe the 2D MVO bear surge and declared bear cycle falling back to 9-APR-2013. As you can see, a triangle formation helped us here at gold and oil as well to protect our money: odds were high to see a fall-down as a resolution of their consolidation characteristics and we took volume + classic TA serious by applying stops. Chart above is /GC 1D TS. Silver Death of silver as well last Friday. We detected a bear volume cycle earlier than gold (26-March) and I made a tighter stop for the white metal on Monday in light of its setup, but later, seeing how it developed I changed that stop a little more reasonable. Finally we are out of silver with our attempt with a minor loss as Monday low was kicked out. Stop hunt was in play for gold and silver last Friday: giant Megalodons ( http://en.wikipedia.org/wiki/Megalodon) of PMs sucessfully managed to target hard stops below 2012 lows. Chart above is SLV 2D MV Please observe the MVO bear surge, the early indication of bear-cyle on SBV. Also please observe divergence in SBV-Flow: on 68% in front of a serious decline in prices. Institutions are not totally bearish. Miners Miners 1D has the same, strange volume setup as gold has: buying volume is still on while prices are down. Shadow-buying is in play with massive volumes. Last Friday was a 200% daily volume/average volume day. Chart above is 2D HUI. Please observe the early declaration of a bearish volume cycle (4th of Apr). Now MVO bear is on, however, because of the shadow-buying action MVO bear is not rising. Equities We took profit and left equities for a while. They were too hot to hold and bearish attacks were efficient. NYMO MA - SPX price divergence continues, same true for SPXA50. As we expected, VIX gap is closed, prices bounced exactly at gap-close. We have an extremely overheated and exhausted bull. Chart above is VIX 1D stockcharts. VIX-gap is closed. Chart above is RUA 2D. While prices are up, long histo is bearish (changed to -7 from -6). Long oscillator is still above the critical value, so might see some 1-2 days up, but it's simply not worth to attempt going long for these, few days. I'd rather go short now if Ben had no B85/month to levitate this market. Oil Oil is in a fake bear volume setup. However, as MFI has a divergence, caution needs to be practiced: bearish forces might take this fake bear and finally drag oil prices down. We are fully out of oil, can book some gains and need to wait for a better setup in order to ride the bull. Chart above is oil 2Df. Dollar As we could predict, Ben is trying to push dollar down in hope of liquidity to flow into equities. Actually RUA long-histo - price divergence signal institutions have no willingness to do so. We could see an MVO bear-surge was developing last week, now both SBVs have elevated selling volumes, also both oscillators have slight bearish indications. As you remember I highlighted Pivot 82.05 and MA 50 as a possible bounce, and I still expect a bounce as price manifestation of this, current MVO bear is not strong enough. Now MVO bear surge started to eliminate: rose to -4 from -6. It means, we might see a few days down, but as soon as MVO bear will be over, dollar will bounce and make a false run upside. Trading update: hold existing stakes. Office memo: I was invited by a large company to go to London first half of next week. I will try to do my best in order to update you, but will be very busy. Office memo2: I still receive subscriptions/extensions. Many thanks for you ! Good luck! Office memo2: there is a congestion in my mailbox. I will try to answer your questions/mails this week I promise.

More Posts... |

|

|

PUBLIC BLOG | MEMBERS | ABOUT SVT | CONTACT |

|

|

(C) 2004-2012 Deric O. Cadora and Atavia, Inc. Terms of Use | Links | Contact Futures and options trading is risky and not suitable for all individuals. |